Here’s how to take control

I’ll be speaking at the Path to Purchase Expo in November, sharing my predictions on where Amazon’s headed in 2020 and beyond – hope to see some of you there!

Most manufacturers would say that when Amazon launches a private label look-alike, it’s their worst nightmare. While it’s true that Amazon’s private label poses threats to leading brands, it can also be an opportunity to learn and grow. In this article, I’ll present how some manufacturers are using Amazon private label to their advantage. I’ll also cover how Amazon’s private label aspirations are likely much larger than anyone thinks.

How big is Amazon’s private label business?

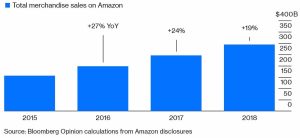

Well, it depends on the category. In 2018, Amazon’s private label sales were $7.5B, or less than 1% of total Amazon sales, even counting large brands like Kindle, Alexa, and Amazon Basics. However, if you’re one of these brands, it certainly doesn’t feel small – and Amazon’s private label share of these categories is much greater.

In fact, anything that pushes your products further down in search results is reason to act. Below, I’ll provide five tactics our clients use to take control. But first…

Why is Amazon interested in private label?

1. Better margins

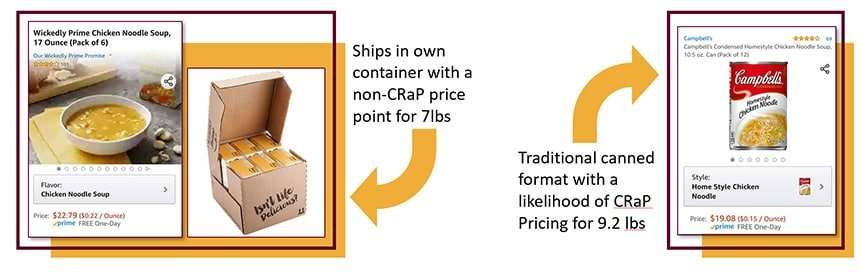

Amazon targets products that are typically margin-challenged, like baby food, diapers, shower gel, batteries, and coffee. These products have traditionally been designed for brick & mortar distribution, and are therefore ripe for modifications to make them more eCommerce friendly, removing costs between production and consumption. Take this Wickedly Prime chicken noodle soup. In addition to being cheaper to ship due to lighter packaging, it’s re-closable, which addresses a key customer complaint about canned items.

2. Building categories (like fashion)

In categories like Fashion, Amazon is still building credibility. Some brands won’t sell to them, and it’s hard to build a business without the Birkenstocks and Paige Denims of the world.

However, Amazon is excellent at listening to the customer. For example, check out this Lark & Ro dress. It addresses all complaints about the top-selling products in this category, and it is priced reasonably. Customers are happy. They got me, this is the dress I’m wearing main article image!

3. Growth (both on and OFF Amazon)

Like many retailers, Amazon is constantly looking for ways to differentiate and ensure customers have reasons to shop exclusively with them. Also, while Amazon’s private label sales accounted for only $7.5B in 2018, or less than 1% of total Amazon sales, their aspirations are likely much greater.

Amazon’s Advertising and AWS businesses are driving Amazon’s growth, while retail growth slows significantly.

According to Retail Dive, over half of product searches start on Amazon, and they want that other half. They also want the 85% of sales that aren’t happening online, and Amazon is working to make that happen.

Where will Amazon get their next-level growth? I’ll tell you: on other platforms, and through other retailers.

While it’s probably a stretch that Walmart would ever carry the Amazon Basics brand, it won’t be long before a brick & mortar fashion retailer picks up something like Lark & Ro. All retailers need growth.

Is this fair?

Yes and no. Many retailers have private label products whose sales represent a more significant portion of the business. For example, Lark and Ro’s revenues pale in comparison to Macy’s Alfani or Nordstrom’s Halogen private label brands. However, a key differentiator is the amount of data Amazon has at their disposal. While brick & mortar may have basket-level or loyalty card data, Amazon is an information machine with detailed data about every product those customers have looked at and purchased. Amazon can run predictive models to assess the likelihood that a consumer purchases any given product at any point in time. Not to mention the data they have on your products’ popularity.

And then there’s the issue of them also being the third largest advertising platform. There’s no mistaking that Amazon is holding the cards here.

What’s a manufacturer to do?

Here are five proven strategies to grow your business despite Amazon’s private label presence in your category:

1. Learn from Amazon

Don’t stick your head in the sand. Order Amazon’s version of your product, or at least examine it, and understand what Amazon is doing better than you. Are the hero images better? Better features? Price points? With one client recently, we discovered that Amazon was selling an 8-pack of the food item vs. the client’s 12-pack. The 8-pack is better at encouraging trial, so the client began offering a smaller pack size in addition to the value pack. Voila!

2. Focus on your product’s differentiating features

Manufacturers often tell me that Amazon is taking away share of search or gaining on them in sales. However, when I compare their product side by side with Amazon’s private label, I can’t tell the difference. These are basic principles of product differentiation, and brands consistently miss them.

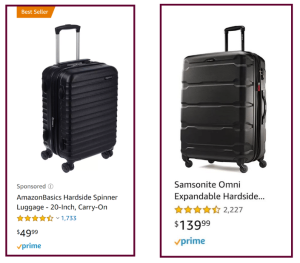

Take this Samsonite suitcase vs. the AmazonBasics brand. I assume the Samsonite version is more feature-packed, which is why the price point is higher. However, after comparing the product detail pages for 10 minutes, I can’t tell what these incremental features are. Make it stand out in your hero image, product title, bullet points, and go heavy on Amazon Advertising bidding for terms that highlight your product’s core differentiators.

3. Understand the impact Amazon’s products are having on your search position – and adjust your paid search strategy

90% of Amazon’s business happens through search, and if you aren’t winning search for your critical keywords, you’re not on the digital shelf. Is Amazon’s private label compromising your position in search? By using Share of Search data for a client recently, we identified a handful of terms where Amazon was gaining share on the page, and we doubled down on offensive and defensive paid search strategies. In addition, we identified several “holes” in Amazon’s bidding strategy – and we put extra spend against those keywords to win.

4. If you see something, say something

Don’t sit quietly while Amazon puts private label ads on your page or while they use proprietary advertising inventory to market their products. Be vocal and say something. Bring it up on your weekly call, during your annual negotiation, or during your quarterly top to top meetings. As for ads on your product detail pages, ask Amazon to take them down. They may not do it, but it’s important to let them know that YOU know, as it may provide you with some much-needed leverage in a future negotiation.

5. Remember that you know your industry best…and use that to your advantage

Amazon’s not shy about employing trial and error tactics to find success, and the same goes for private label. For example, as a Divisional Manager for Amazon’s baby category, I was once responsible for choosing patterns for our private label crib sheets. While I was great at managing a category at Amazon, I knew nothing about product development. (A Pottery Barn-esque light green gingham plaid? Or a more Babies-R-Us cute animal print? I chose the gingham, and the end-of-season markdowns just about killed me. But I digress…)

Point being, Amazon doesn’t always have experts in charge of these launches. They’re throwing stuff at the wall to see what sticks, and they’re wrong a lot. For many of our clients, product development is a core strength. Use it to stay on top of trends, consumer preferences, and technology. Don’t let Amazon get ahead of you!

What tactics do you employ to compete with Amazon’s private label? How do you remain competitive?