This article was originally published in Forbes.

The pandemic-driven seismic shift to e-commerce has caught many manufacturers by surprise. In 2015, an established CPG brand might have done a mere 3%-5% of its overall business (defined as brick-and-mortar plus e-commerce) online. During the peak of Covid-19, many consumer brand organizations have grappled with the consequences of 30%-40% of their entire business occurring online, and more specifically on Amazon.

This change has sent consumer brands reeling to not only get Amazon right (because if you get Amazon right, you win the internet), but also ensure that they’re set up for success on Walmart.com, Target.com and other marketplace platforms.

What is a marketplace?

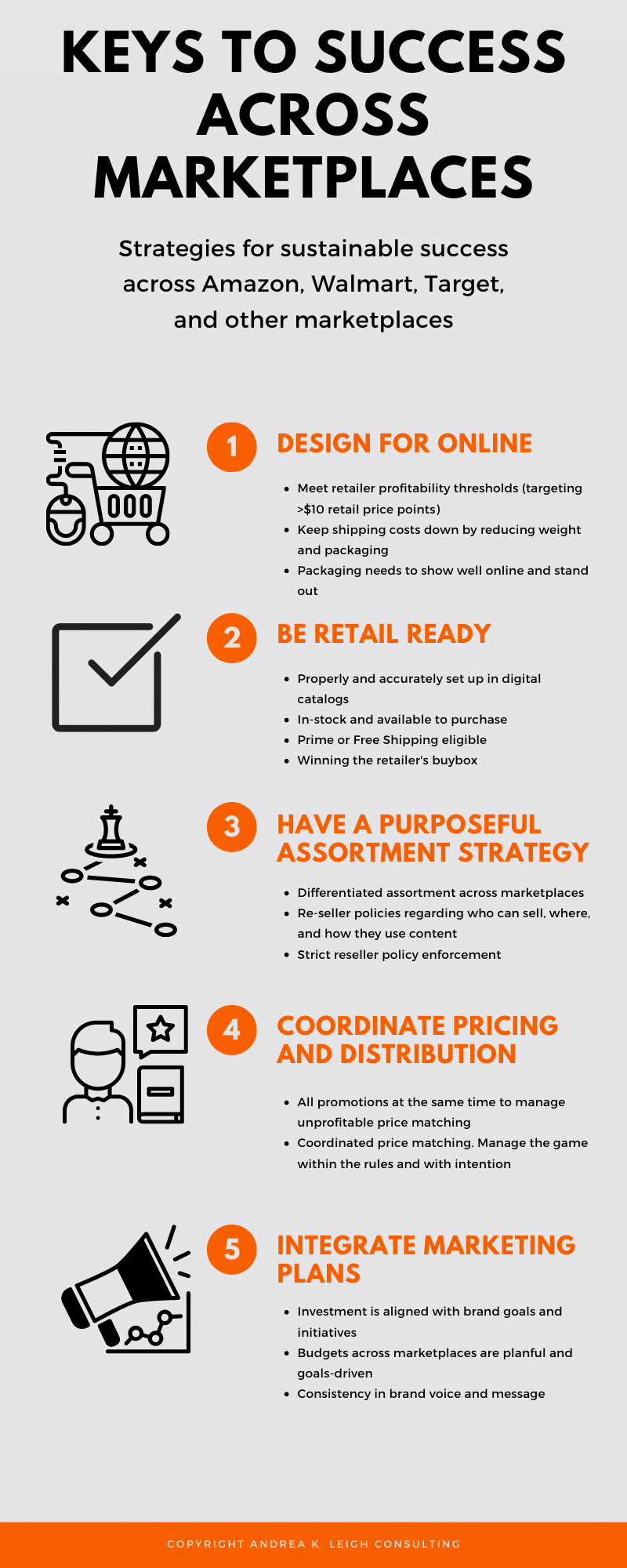

Marketplaces are platforms where multiple brands come together and sell their products. While there are nuances to each platform, as I’ve written previously, our work with over 350 consumer brands suggests that the keys to success boil down to the following five practices:

1. Design for online.

To have a sustainable e-commerce revenue stream, items must be well designed for e-commerce. This means they meet marketplace retailer profitability targets once you include shipping costs to the end consumer. Because many e-commerce orders contain only one item, each item’s profit must “stand on its own.”

According to the Boston Consulting Group, “Larger pack sizes can encourage stock-up behavior and also help push the transaction up to $10 to $15—the point at which the shipping economics often improve for any given individual item.” Manufacturers may need to change pack sizes, engage in co-packing or innovate to reduce weight. For example, innovations such as laundry detergent pods and single-serve coffee seem like they’ve been on the digital shelf forever, but they were actually born to be better designed for e-commerce profitability and success.

Lastly, items must have packaging that clearly shows the differentiating benefits and stand out in search results.

2. Be retail-ready (boring but important).

According to Accenture Interactive, 81% of customers who bought a name-brand product on Amazon in the last three months recalled the product detail page, while only 28% of those same customers recalled a commercial for the product. Therefore, it’s important to get your house in order. Often a client has been burning to move forward with complex marketing strategies, only to be hampered by missing product page images or rampant out-of-stocks. Retail readiness may include ensuring products are in stock, winning the marketplace buy box and being eligible for free shipping.

Retail readiness also includes having items accurately set up in the digital catalog. Garbage in equals garbage out. What you put into the digital catalog may show up on your product pages, becoming your de facto marketing copy. Additionally, automated product-receive processes in warehouses may gag on incorrect product data, resulting in delays and out-of-stocks.

Lastly, customers shop across marketplaces, and they expect consistency in your brand packaging, voice, images, etc. According to Big Commerce, “Channel loyalty is a thing of the past.”

3. Have a purposeful assortment strategy.

Amazon, Walmart, Target and other marketplaces are in fierce competition with one another, so brands must acknowledge and expect pricing wars. Assortment strategies that provide a differentiated assortment for each retailer are common to circumvent the pricing “race to the bottom” that erodes brand value and brand perception. While yesterday’s prevailing best practice was to offer as much assortment as possible online (more assortment = more traffic = more sales), the tide has turned, and differentiation is making a comeback.

There are multiple levels of differentiation:

• In an undifferentiated assortment model, the manufacturer offers the same assortment across marketplaces. The downside of this strategy is that marketplace retailers will price match one another, resulting in price and margin compression.

• In a partially differentiated assortment model, the consumer brand offers some differentiated assortment to each marketplace platform. This practice protects against some cross-marketplace pricing wars and preserves some retailer and consumer brand margins.

• In a fully differentiated assortment model, all the consumer brand’s assortment is unique to each retailer. This protects completely against price matching wars between retailers and preserves both retailer and consumer brand margins.

4. Coordinate pricing and distribution.

In the days of brick-and-mortar, consumer brands typically scheduled retailer promotions to give each retailer its turn promoting and discounting product. However, in the marketplace model, this strategy often backfires because retailers price match one another in real time. As a result, the brand’s products are always “on sale.”

Because the consumer brands aren’t funding every retailer’s price discount, this practice can lead to retailer margin compression and tense relationships and negotiations between vendor and retailer. Thus, coordination of marketplace promotional activities is key, such as the consumer brand offering all promotions to all retailers at the same time or engaging in partially differentiated assortment models.

5. Integrate marketing plans.

Now that all the major marketplaces have their own advertising platforms, it’s imperative to approach the ad platforms with a comprehensive strategy in mind. While there’s no one-size-fits-all approach to allocating time and ad budgets, there are some important questions to consider:

1. Where is my customer shopping, and how can I ensure a seamless, branded experience for them?

2. Which platform is driving my growth, and which platform do I want to drive growth on?

3. What are my profitability goals for each marketplace?

4. Where is my advertising most effective? How does my marketplace advertising affect my brick-and-mortar business? Is there an “early mover” advantage with ad platforms?

5. How does my ad strategy play into my direct-to-consumer website strategy, if I have one?

The pandemic has accelerated not only e-commerce sales growth but marketplace expansion and advertising by several years. It can be a disorienting place for a consumer brand that is accustomed to a primarily brick-and-mortar business model. However, by leveraging a few key principles that scale well across marketplaces — design for online, retail readiness, a purposeful assortment strategy and coordinated pricing and distribution — brand manufacturers can successfully and sustainably navigate the cross-platform e-commerce waters.