Three Reasons CPGs Should Worry About “Ankle-Biter” Competitors Online

I sat in on a meeting recently where a large, established CPG client reviewed their competitive market data. After looking at several graphs and pie charts comparing them to the other top three competitors (while their team explained and defended basis points increases and decreases in market share), I took notice of one pie chart in particular.

5 Reasons Why Cross-Platform Strategy is Critical for Success

If you’re a consumer brand, you’re likely finding yourself with a surprising amount of your business having shifted online as a result of the COVID-19 pandemic. Consumers have never bought so many things online. From groceries to beauty products to Peloton bikes, it seems consumers have gone ecommerce-mad.

Three Better Input Metrics Than Market Share In Measuring eCommerce Success

When measuring eCommerce success, there are three better input metrics than market share that should be utilized. A representative of a large global beauty brand recently said to me, “Our strategic goal for Amazon this year is to gain our fair market share.” I’ve written previously about how while market share might work to measure your brick-and-mortar business, it’s a deeply flawed metric on e-commerce sites such as Amazon, Target and Walmart.

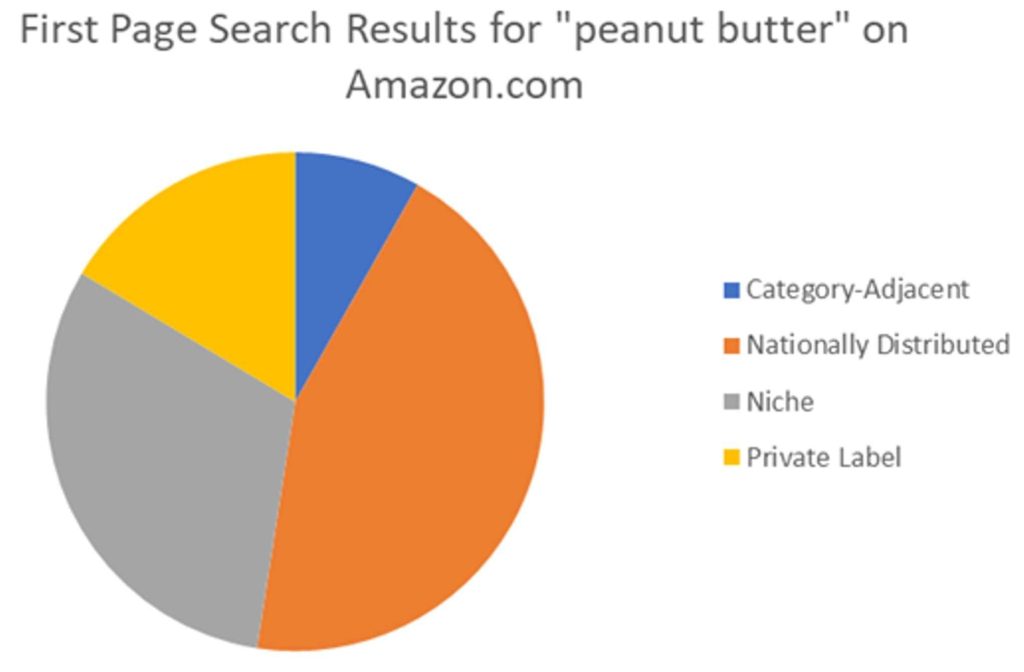

How Scrappy, Disruptive Brands are Stealing Market Share on Amazon

Both in my consulting practice and during my ten years at Amazon managing categories, I have repeatedly witnessed the remarkable rise of a certain type of brands to large, competitive players in their categories. The Grocery Manufacturer’s Association and BCG released a report that stated, “…brick-and-mortar market share and shelf-space prominence do not translate into digital sales, and nimble new competitors with disruptive strategies…stake out leadership positions and are then hard to dislodge.”